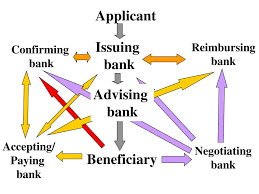

开证行、通支行、议付行和偿付行,你不知道的信用证“四大行”?

开证行、通支行、议付行和偿付行是信用证支付方式下的国际贸易涉及到的几个不同当事人。

开证行(issuing bank),通常为进口方所在地银行,开证行接受开证申请人的申请开立信用证,且有责任到期付款。其英文释义为:An issuing bank (also called an issuer) is part of the 4 party model of payments. It is the bank of the consumer (also called a cardholder) and is responsible for paying the merchant’s bank (called an Acquiring Bank or Acquirer) for the goods and services the consumer purchases.

通知行或联行(notifying bank or advising bank),即出口方所在地银行,也可以是开证行的分行或联行。通知行按照开证行说明将信用证传递给出口方,其只负责证明信用证的真实性,没有其他责任。An advising bank (also known as a notifying bank) advises a beneficiary (exporter) that a letter of credit (L/C) opened by an issuing bank for an applicant (importer) is available. An advising bank's responsibility is to authenticate the letter of credit issued by the issuer to avoid fraud.

议付行(negotiating bank),负责按信用证项下的跟单汇票支付给受益人款项。议付行可以是开证行或信用证指定其他银行。如果信用证中无特殊规定,出口方可以把跟单汇票交给任意银行来完成交易。其英文释义为:Negotiating bank is one of the main parties involved under Letter of Credit. Negotiating Bank,is the one who negotiates documents delivered to bank by beneficiary of LC. Negotiating bank is the bank that verifies documents and confirms the terms and conditions under LC on behalf of beneficiary to avoid discrepancies.

偿付行(reimbursing bank),指信用证中要求支付的银行,通常是开证行或信用证指定的其他银行。其英文释义是:Reimbursing bank is the bank that, at the request of the issuing bank, is authorized to pay, or accept and pay time draft under a documentary credit in accordance with UCP 600 article 13 or if incorporated, the ICC uniform Rules for Bank-to-Bank Reimbursements under Documentary Credits

如:

1. AN issuing bank undertakes to reimburse a nominated bank that has honoured or negotiated a complying presentation and forwarded the documents to the issuing bank. Reimbursement for the amount of a complying presentation under a credit available by acceptance or deferred payment is due at maturity, whether or not the nominated bank prepaid or purchased before maturity.

开证行保证向对于相符提示已经予以兑付或者议付并将单据寄往开证行的被指定银行进行偿付。无论被指定银行是否于到期日前已经对相符提示予以预付或者购买,对于承兑或延期付款信用证项下相符提示的金额的金额的偿付于到期日进行。

2. Any bank, other than the advising bank, who are requested to transfer this credit, must request the permission from the issuing bank by SWIFT.

任何银行,除了通知行要求转让此信用证,必须用SWIFT电文通知开证行得到其许可。

3.Negotiating bank may claim reimbursement by T/T on the Bank of China New York branch certifying that the credit terms have been complied with。

议付行证明本信用证条款已履行,可按电汇索偿条款向中国银行纽约分行索回货款。

4.If a reimbursing bank's charges are for the account of the beneficiary, they shall be deducted from the amount due to a claiming bank when reimbursement is made.

如偿付行的费用系由受益人承担,则该费用应在偿付时从支付索偿行的金额中扣除。