一文了解High-Low Method

What Is the High-Low Method?

什么是高低点法?

In cost accounting, the high-low method is a way of attempting to separate out fixed and variable costs given a limited amount of data. The high-low method involves taking the highest level of activity and the lowest level of activity and comparing the total costs at each level.

在成本会计中,高低点法是一种在数据有限的情况下试图将固定成本和可变成本区分开来的方法。高低点法是指取最高活动水平和最低活动水平,比较每个水平的总成本。

If the variable cost is a fixed charge per unit and fixed costs remain the same, it is possible to determine the fixed and variable costs by solving the system of equations. It is worth being cautious when using the high-low method, however, as it can yield more or less accurate results depending on the distribution of values between the highest and lowest dollar amounts or quantities.

如果可变成本是每单位的固定费用,而固定成本保持不变,则可以通过求解方程组来确定固定成本和可变成本。不过,在使用高低点法时一定要谨慎,因为根据最高和最低金额或数量之间的数值分布,高低点法得出的结果可能更准确,也可能不那么准确。

Understanding the High-Low Method

了解高低点法

Calculating the outcome for the high-low method requires a few formula steps. First, you must calculate the variable cost component and then the fixed cost component, and then plug the results into the cost model formula.

计算高低点法的结果需要几个公式步骤。首先,必须计算可变成本部分和固定成本部分,然后将计算结果输入成本模型公式。

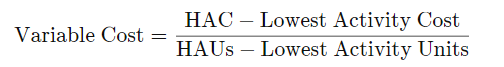

First, determine the variable cost component:

首先,确定可变成本部分:

where:

HAC=Highest activity cost

HAUs=Highest activity units

Variable cost is per unit

其中

HAC=最高活动成本

HAU=最高活动单位

可变成本为单位成本

Next, use the following formula to determine the fixed cost component:

然后,使用以下公式确定固定成本部分:

Fixed Cost=HAC−(Variable Cost×HAUs)

固定成本=HAC-(可变成本×HAUs)

Use the results of the first two formulas to calculate the high-low cost result using the following formula:

利用前两个公式的结果,用以下公式计算高低成本结果:

High-Low Cost=Fixed Cost+(Variable Cost×UA)

高低成本=固定成本+(可变成本×UA)

where:

UA=Unit activity

其中

UA=单位活动

What Does the High-Low Method Tell You?

高低点法能说明什么?

The costs associated with a product, product line, equipment, store, geographic sales region, or subsidiary, consist of both variable costs and fixed costs. To determine both cost components of the total cost, an analyst or accountant can use a technique known as the high-low method.

与产品、产品线、设备、商店、销售区域或子公司相关的成本包括可变成本和固定成本。为了确定总成本中的这两个成本部分,分析师或会计师可以使用高低点法。

The high-low method is used to calculate the variable and fixed cost of a product or entity with mixed costs. It takes two factors into consideration. It considers the total dollars of the mixed costs at the highest volume of activity and the total dollars of the mixed costs at the lowest volume of activity. The total amount of fixed costs is assumed to be the same at both points of activity. The change in the total costs is thus the variable cost rate times the change in the number of units of activity.

高低点法用于计算具有混合成本的产品或实体的可变成本和固定成本。高低点法考虑了两个因素。包括考虑了活动量最大时的混合成本总额和活动量最小时的混合成本总额。假定这两个活动点的固定成本总额相同。因此,总成本的变化就是可变成本率乘以活动单位数量的变化。

KEY TAKEAWAYS

要点

·The high-low method is a simple way to segregate costs with minimal information.

·高低点法是一种利用最少信息进行成本分离的简单方法。

·The simplicity of the approach assumes the variable and fixed costs as constant, which doesn't replicate reality.

·这种方法的简便性是假定可变成本和固定成本是不变的,但这并不符合实际情况。

·Other cost-estimating methods, such as least-squares regression, might provide better results, although this method requires more complex calculations.

·其他成本估算方法,如最小二乘回归法,可能会提供更好的结果,尽管这种方法需要更复杂的计算

Example of How to Use the High-Low Method

如何使用高低点法举例

For example, the table below depicts the activity for a cake bakery for each of the 12 months of a given year.

例如,下表描述了一家蛋糕面包店在某一年 12 个月中每个月的活动。

Below is an example of the high-low method of cost accounting:

以下是高低点法成本核算的示例:

|

Month |

Cakes Baked (units) |

Total Cost ($) |

|

January |

115 |

$5,000 |

|

February |

80 |

$4,250 |

|

March |

90 |

$4,650 |

|

April |

95 |

$4,600 |

|

May |

75 |

$3,675 |

|

June |

100 |

$5,000 |

|

July |

85 |

$4,400 |

|

August |

70 |

$3,750 |

|

September |

115 |

$5,100 |

|

October |

125 |

$5,550 |

|

November |

110 |

$5,100 |

|

December |

120 |

$5,700 |

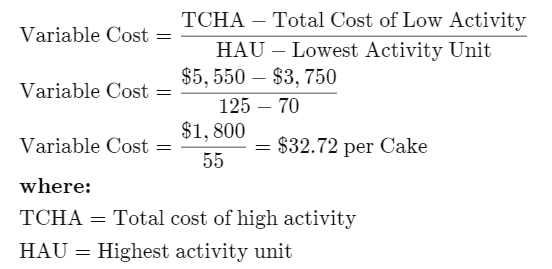

The highest activity for the bakery occurred in October when it baked the highest number of cakes, while August had the lowest activity level with only 70 cakes baked at a cost of $3,750. The cost amounts adjacent to these activity levels will be used in the high-low method, even though these cost amounts are not necessarily the highest and lowest costs for the year.

10 月份面包店的活动量最大,烘烤了最多的蛋糕,而 8 月份的活动量最小,只烘烤了 70 个蛋糕,成本为 3,750 美元。在高低点法中,将使用与这些活动水平相邻的成本金额,尽管这些成本金额不一定是全年的最高和最低成本。

We calculate the fixed and variable costs using the following steps:

我们按以下步骤计算固定成本和可变成本:

1. Calculate variable cost per unit using identified high and low activity levels

根据已确定的高活动量和低活动量计算单位可变成本

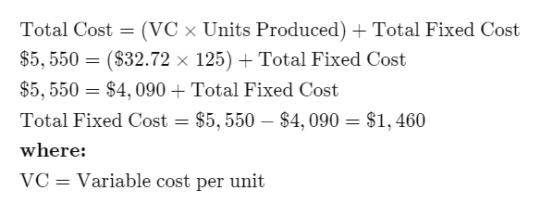

2. Solve for fixed costs

计算固定成本

To calculate the total fixed costs, plug either the high or low cost and the variable cost into the total cost formula:

要计算固定成本总额,可将高成本或低成本和可变成本输入总成本公式:

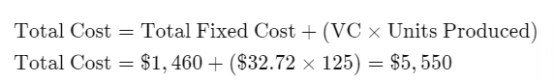

3. Construct total cost equation based on high-low calculations above

根据上述高-低计算,建立总成本方程

Using all of the information above, the total cost equation is as follows:

利用上述所有信息,总成本方程如下:

Limitations of the High-Low Method

高低点法的局限性

The high-low method is relatively unreliable because it only takes two extreme activity levels into consideration. The high or low points used for the calculation may not be representative of the costs normally incurred at those volume levels due to outlier costs that are higher or lower than would normally be incurred. In this case, the high-low method will produce inaccurate results.

高低点法相对不可靠,因为它只考虑了两个极端的活动水平。用于计算的高点或低点可能并不代表在这些活动量水平下正常发生的费用,原因是离群费用高于或低于正常发生的费用。在这种情况下,高低点法会产生不准确的结果。

The high-low method is generally not preferred as it can yield an incorrect understanding of the data if there are changes in variable or fixed cost rates over time or if a tiered pricing system is employed. In most real-world cases, it should be possible to obtain more information so the variable and fixed costs can be determined directly. Thus, the high-low method should only be used when it is not possible to obtain actual billing data.

如果可变成本或固定成本费率随时间发生变化,或采用分级定价系统,则高低点法可能会导致对数据的不正确理解,因此一般不推荐使用高低点法。在大多数实际情况下,应该可以获得更多信息,从而直接确定可变成本和固定成本。因此,只有在无法获得实际账单数据时,才应使用高低点法。

By WILL KENTON

作者:威尔-肯顿

Updated April 19, 2022

2022 年 4 月 19 日更新

Reviewed by DAVID KINDNESS

审核:DAVID KINDNESS

Fact checked by SUZANNE KVILHAUG

事实核查:SUZANNE KVILHAUG

英文来源:Investopedia